Focusing on Sustainability

India’s first VC firm to integrate SDG investing for enhanced returns

At IvyCap, responsible investing entails a wide spectrum of investment strategies and approaches centered on generating returns sustainably. We constantly adopt existing solutions focused on creating lasting value for all our stakeholders - ranging from ESG strategies, exclusions and integration to thematic investing.

Traditional

investments

Exclusion

ESG Integration

Thematic investing

aligned

Impact

Investing

Return First

Impact First

Philanthropy

Delivering competitive financial returns

Mitigating environmental, social and governance (ESG) risks

Pursuing environmental,social and governance (ESG) opportunities

Focusing on measurable high-impact solutions

Investing through the SDG lens

At IvyCap, we’re committed to creating impact over and above financial returns. As such, we invest through the SDG Framework - UN’s blueprint to achieve a better and more sustainable future by 2030.

No poverty

Eradicating poverty in all its forms is not just important but necessary in its true sense. Reports claim that the number of people living in extreme poverty dropped by more than half between 1990 and 2015.

Portfolio companies working towards SDG

Zero hunger

It is indeed unfortunate but true that extreme hunger and malnutrition pose an immense threat to the progress of any country. Incidents of environmental degradation, biodiversity loss, and drought have had a direct impact on the hunger problem.

Good health and well-being

Universal health coverage is a significant point in realising this goal of SDG. Life expectancy has increased thereby declining maternal and infant mortality rates. Importantly, deaths from HIV and malaria have decreased drastically.

Portfolio companies working towards SDG

Quality education

Since the last 20 years, tremendous efforts have been directed towards achieving the target of universal primary education. Several reports developing regions have witnessed enrolment of 91 percent in 2015.

Gender Equality

While there has been remarkable progress in the notions about gender equality, there still exists large inequalities and disparity in several areas. There are cases where women are denied the same work rights as their male counterparts.

Portfolio companies working towards SDG

Clean water and sanitation

There are several countries that are experiencing drought and desertification, thereby leading to worsened water stress. In order to ensure affordable and safe drinking water, it is important for investment in infrastructure, sanitation, and proper hygiene.

Affordable and clean energy

The demand for cheap energy, strive towards an economy completely based on fossil fuels will never cease to exist. Thus, to achieve the goal of affordable and clean energy it is important that investments in solar, wind, and thermal power are made.

Decent work and economic growth

Widening inequalities in the economic growth chart, insufficient jobs are continuously hampering the growth of the labour force. Entrepreneurship and job creation should be encouraged as effective measures in order to bring an end to the forced labourers.

Portfolio companies working towards SDG

Industry, innovation and infrastructure

Sufficient investment in infrastructure and innovation are the primary growth drivers of economic prosperity. Mass transport and renewable energy along with information and communication technologies are important components of the same.

Portfolio companies working towards SDG

Industry, innovation and infrastructure

Sufficient investment in infrastructure and innovation are the primary growth drivers of economic prosperity. Mass transport and renewable energy along with information and communication technologies are important components of the same.

Portfolio companies working towards SDG

Sustainable cities and communities

Sustainable development of any nation can only be achieved by improving the living condition of the people in urban areas. Rising population and increasing migration lead to the development of the cities.

Portfolio companies working towards SDG

Responsible consumption and production

Reducing ecological footprint by changing the way we produce and consume goods and resources is the need of the hour. Efficient management of natural resources and sustainable waste management can make a vast difference to mankind and the society.

Portfolio companies working towards SDG

Climate action

According to reports it is estimated that the annual average economic losses from climate-related disasters are in the hundreds of billions of dollars. These help in integrating disaster risk measures and sustainable natural resource management.

Life Below Water

Oceans have a capacity of absorbing approximately 30 percent of the carbon dioxide produced by humans. Marine pollution has touched an alarming level. Reports show that an average of 13,000 pieces of plastic litter is found on every square kilometre.

Life on land

Plant life constitutes about 80 percent of the human diet. In addition, agriculture is one of the most important aspects of economic resources. Forests serve as vital habitats for millions of species, and important sources for clean air and water.

Peace, justice and strong institutions

While there is peace, security and prosperity in some regions of the world, others are still struggling to bring an end to the acts of conflict and violence. This is not inevitable and must be addressed.

Portfolio companies working towards SDG

Partnerships for the goals

While all the SDGs are discussed and deliberated upon, the realisation can only be achieved with strong global partnerships and cooperation. With technological advancements, the world in today’s time is more interconnected than ever.

Measuring impact

- What: Tells what outcome the enterprise is contributing to, whether it is positive or negative, and how important the outcome is to stakeholders.

- Who: Tells which stakeholders are experiencing the outcome and how underserved they are in relation to the outcome.

- How much: Tells how many stakeholders have experienced the outcome, what degree of change they experienced, and how long they experienced the outcome for.

- Contribution: Tells whether an enterprise’s and/or investor’s efforts resulted in outcomes that were likely better than what would have occurred otherwise.

- Risk: Tells the likelihood of whether the impact will be different than expected.

SDG for investors

External disclosure and reporting

To report on performance to external stakeholders. (Largely backward - looking) and enable them to make informed decisions

Impact management tools

To enable and facilitate better and more efficient decision making

High Level Principles

To set purpose and direction

Decision making framework

Making better and more efficient decisions in line with high - level principles and contributing positively to substainable development and achieving SDGs

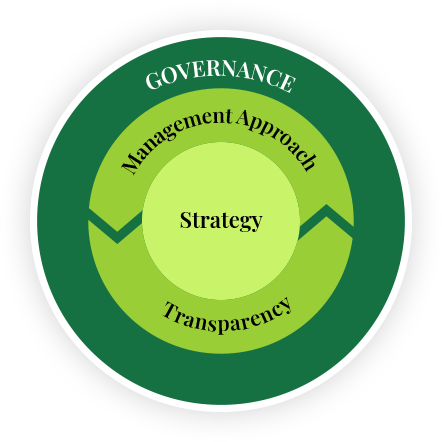

SDG IMPACT STANDARDS

SDG Impact Standards

Investors can leverage these SDG impact standards to frame their investment guidelines, identify relevant questions for Funds and Fund Managers, and push for greater standardization of practice and external assessment of Funds. Alternatively, they can use these Standards to push for greater standardization of practice and external assessment of Funds making SDG and other sustainability-related claims.

Standard 1

(Strategy):

Standard 2

(Management Approach):

Standard 3

(Transparency):

Standard 4

(Governance):

SDG for enterprises

Our Sustainability Partner

Fandoro Technologies Pvt Ltd. is our chosen sustainability partner that guides and supports IvyCap Ventures in our journey of responsible investment. Fandoro curates the core sustainability principles that meet our objectives and helps us achieve them by working with the investee companies to align their efforts with the sustainability goals. This ensures that our portfolio creates a significant positive impact on the environment and society, while maintaining the highest level of transparency in our governance by the fund.

Know more